The History of the Automotive Industry: Key Milestones That Drove Innovation

Did you know the automotive industry employs around 9.9 million Americans? That’s roughly 5.1% of the entire private-sector employment, proving it’s not just a passion but a “wheely” good career choice for those who turn their love for cars into a livelihood.

It’s hard to believe that, despite being one of the largest parts of the economy, the automotive world moved online almost ten years after most other retail industries.

Today, the industry is undergoing a rapid transition to a digital landscape. With evolving buyer expectations and growing demand for convenience, innovation continues to drive the automotive sector forward, reshaping how we buy, sell, and think about vehicles.

From the ‘horseless carriages’ to today’s electric vehicles and self-driving tech, it’s been an incredible journey. And there’s a lot to be proud of.

We’ve rounded up some of the most fascinating milestones in the history of the automobile industry and what the new normal looks like in the age of automotive eCommerce.

A brief timeline of how the automotive industry evolved

The 1880s: The dawn of the automobile industry

The roots of the auto industry trace back to the late 19th century. In 1886, Karl Benz registered the first “horseless carriage” in Germany, officially marking the start of the modern automobile era with his invention, the Motorwagen.

The 1890s: Benz – the world’s car market leader

1899 — 572 vehicles were manufactured.

1903 — 30,124 cars were manufactured in France only (63% more than the US did).

The 1890s – 1945s: Getting the American automobile industry on the map

Henry Ford’s Era

Back in Henry Ford’s days, the auto industry followed a “supply-push” model focused on mass production of various car brands and relying on heavy marketing to drive demand. It was all about volume.

At the same time, a volatile market economy led many traditional dealerships to raise prices while cutting back on customer service, making it harder for buyers to get both value and support.

First Dealer Networks

The ‘supply-push’ model has grown into dealer networks, which were created to hold inventory, leverage private capital, and offer service and support for less reliable and more maintenance-intensive products.

Dealer networks were typically run by local entrepreneurs who operated within a specific region and carried just one or two car brands. Back then, aggressive pricing strategies were driven by customers who were willing to pay. The real competition wasn’t between different car brands; it was often between dealers selling the same brand just a few miles apart.

1925: Chrysler is founded

In June 1925, Walter Chrysler founded the Chrysler Corporation, having reorganized the struggling Maxwell Motor Company under a new name. Over the past 30 years, Chrysler has experienced numerous financial ups and downs, leading to several partnerships and ownership changes.

Chrysler, along with General Motors and Ford, is known as one of the “Big Three” U.S. automakers. Today, it’s part of Stellantis but still based in Michigan, near Detroit.

The 1940s-1950s: World War II and post-war pricing anarchy

While car sales paused during wartime, things shifted quickly once the war ended. As people returned to everyday life, the auto industry kicked into high gear, ushering in the famous “Car Boom.”

But with booming demand came pricing chaos. To bring order to the showroom floor, Senator Almer Monroney stepped in with a new rule: every car had to display a sticker showing the suggested retail price and a breakdown of its features – something we now know as the Monroney label.

The 1950s-1970s: The advent of American car brands

The 1950s and ’60s were a golden era for the automotive world. This period gave us iconic cars that are now considered classics – vehicles that not only helped define the industry but also shaped design, engineering, and pop culture. From bold innovations to unforgettable styling, their impact is still felt today.

Chevrolet Corvette (1953-Present)

The Chevrolet Corvette, known as America’s first real sports car, stood out with its fiberglass body, sharp design, and strong V8 engine. Since then, it has remained a favorite, representing solid performance and smart engineering.

Ford Mustang (1964 – Present)

The Mustang started the pony car trend, combining affordability with sporty performance. Its success inspired competitors like the Chevrolet Camaro and Dodge Challenger, helping define the muscle car era in America.

Dodge Charger (1966-Present)

Known for its bold looks and powerful V8 engines, the Dodge Charger made a name for itself as a classic American muscle car. Appearances in movies like Bullitt and The Fast and the Furious helped cement its spot in pop culture.

However, by 1973, overall car production costs in the United States had skyrocketed due to the increasing price of gasoline. As a result, car manufacturers slashed the number of models on the production line. As the cost of manufacturing increased, car prices also rose.

The 1980s-1990s: Marketing is transforming public views on cars

In the 1980s, car marketing played a significant role in shaping people’s perceptions of cars. Automakers spent heavily on ads that emphasized what made their vehicles stand out. Big-name celebrities and flashy TV commercials helped build brand loyalty and trust. More than just transportation, cars were promoted as part of a lifestyle, something fun, exciting, and personal.

Source: MOTORTREND

By the 1990s, car marketing shifted focus to highlight new technology and environmental responsibility. Automakers promoted better fuel efficiency, lower emissions, and added safety features, such as Electronic Stability Control and early GPS systems. Ads aimed to connect with tech-focused buyers while also reflecting the growing concern for the environment, showing how cars were becoming cleaner and more efficient.

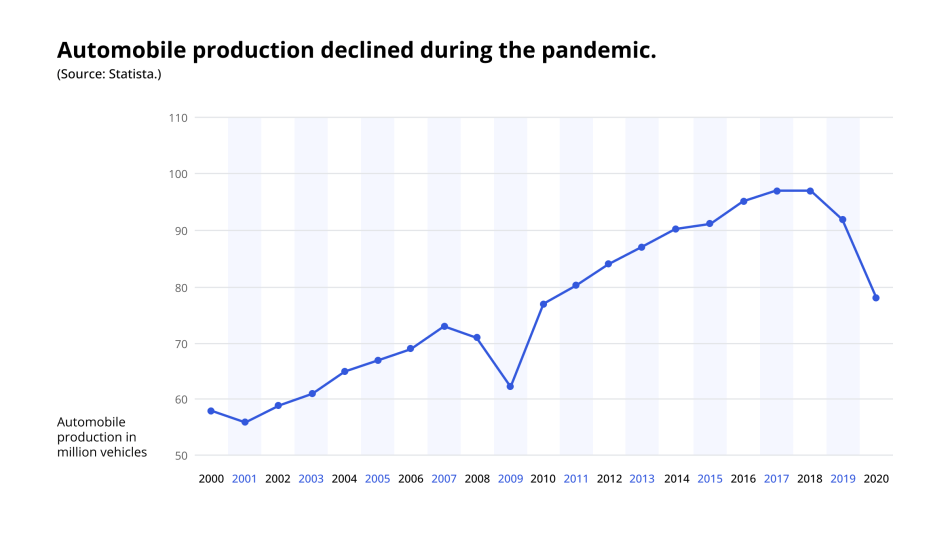

The 2000s: Automotive industry crisis in the United States

The automotive industry faced a major crisis in the 2000s, with production hit particularly hard. The struggle to adapt to shifting economic conditions and changing consumer preferences became increasingly clear. As fuel prices rose, American manufacturers, who had long focused on larger vehicles, saw demand decline, while foreign competitors, primarily from Asia, gained ground with more fuel-efficient models.

The situation worsened during the 2007 economic recession and the resulting credit crunch.

Worldwide automobile production dropped by 12.4%. U.S. auto sales fell sharply, dropping from 17 million units in 2006 to just 10.6 million in 2009.

In response, the U.S. government provided roughly $80 billion in emergency funding to help keep the industry afloat and protect millions of related jobs. In 2009, both General Motors and Chrysler declared bankruptcy. The financial support came with strings attached – businesses were expected to prioritize fuel efficiency and embrace more sustainable practices.

By the early 2010s, GM and Chrysler had not only regained profitability but also repaid their loans ahead of schedule. However, that crisis marked a pivotal moment, fundamentally changing how American car manufacturers approached innovation, efficiency, and global competitiveness.

Source: EBSCO

2020-2021: The COVID Era and Inflation Hurdles

The COVID-19 pandemic brought significant disruption to many industries, but the automotive and parts sectors were among the most severely affected. Factory closures, labor shortages, and widespread lockdowns were the leading causes of production delays. One of the most significant setbacks was the global shortage of semiconductors (critical components in modern vehicles!) resulting from supply chain disruptions.

The chip shortage has halted vehicle manufacturing worldwide, resulting in inventory shortages and extended delivery times for consumers. Automakers were forced to cut output, prioritize high-margin models, and, in some cases, ship vehicles without certain features.

The aftermarket parts industry also felt the ripple effects. With fewer new cars on the road and rising prices for available models, more consumers turned to repairing and maintaining older vehicles, which increased demand for replacement parts. Still, supply chain constraints made it challenging to meet demand.

Following the COVID-19 pandemic, the industry faced new challenges. Inflation and rising interest rates put pressure on both manufacturers and consumers. Vehicle prices remained high due to ongoing inventory issues, and affordability became a growing concern.

At the same time, parts distributors and retailers had to navigate increased shipping costs, raw material shortages, and shifting consumer behavior, including a growing reliance on eCommerce and DIY repairs.

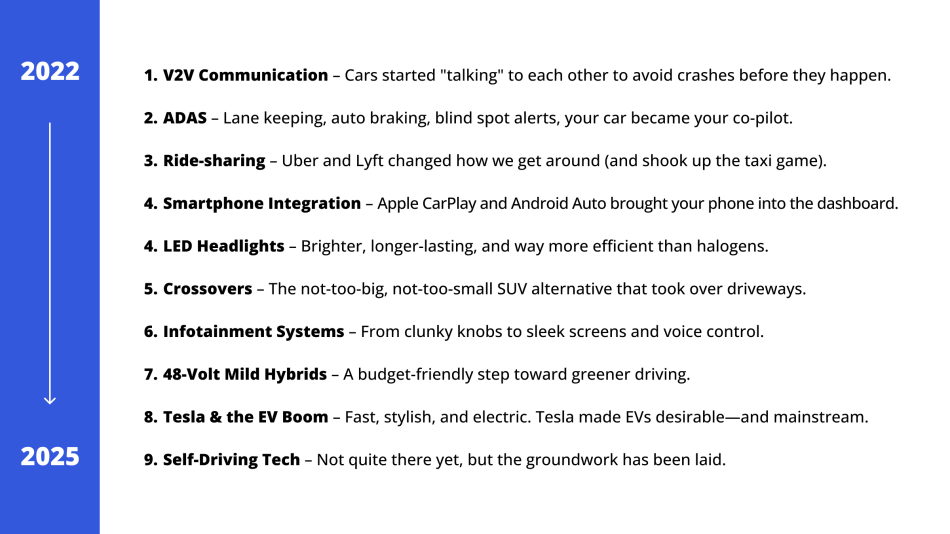

2022 to Present: Smarter Tech and Greener Engines

Recent trends have been transforming the automotive industry. From advanced safety technologies to electric vehicles that rival traditional engines, these innovations are redefining how we drive.

Encouraged by consumer demands for safety and convenience, automakers are rapidly adopting smarter, tech-driven methods for car manufacturing, including the use of AI, robotics, IoT, and data analytics, to boost efficiency and quality. Ford Motor Company, for instance, is leading the charge with cutting-edge innovations that raise industry standards.

Sustainability is also shaping the future – we are now witnessing a clear transition to cleaner power with the introduction of hydrogen engines. Approximately 17,000 hydrogen-powered vehicles are currently on the U.S. roads, primarily in California. Brands like Honda and Toyota are investing heavily in hydrogen internal combustion engines, which offer the familiarity of traditional engines with zero carbon emissions. They’re reliable, durable, and may just be the next big thing in green mobility.

eCommerce Takes the Wheel – New Challenges, New Opportunities

By 2025, buying cars and auto parts online has become the go-to method for both consumers and businesses. Traditional dealerships, once the default source for parts, are losing ground. Outdated practices, such as unclear pricing, printed catalogs, and limited inventory access, are driving more people toward faster, smarter digital options.

🔍👉 Buyers Want Simplicity, Speed, and Transparency

Modern customers expect clear pricing, up-to-date inventory, and detailed product information to be readily available, including fitment data, customer reviews, and how-to guides.

🔍👉 Faster Fulfillment is the New Standard

Automated warehouses, smart logistics, and robotics are making same-day and next-day delivery more common.

🔍👉 Fitment and Accuracy are Top Priorities

Advanced tools like VIN-based part lookups and compatibility checks are reducing returns and frustration.

🔍👉 Smarter Tech is Changing the Game

In today’s aftermarket landscape, serious tech isn’t optional – it’s the new normal. Automotive businesses won’t be able to succeed online with outdated tools or bare minimum solutions.

With large catalogs, high-resolution images, and peak traffic days, performance, speed, and security are critical. Your platform should deliver a seamless experience, regardless of how complex your inventory becomes.

And when it comes to selling parts, accurate fitment search and advanced filtering aren’t just nice-to-have, they’re make-or-break features that drive conversions and customer satisfaction.

The automotive world goes way beyond what a simple eCommerce platform has to offer. It’s about the experience. It’s about community. It’s about making sure that you find exactly what you need. It’s speed, comfort, and configurability. An eCommerce seller has to make sure that the whole experience and the sense of community live up to the buyer’s expectation because these are going to make them fans in the future.

A Complete Solution for Selling Auto Parts Online

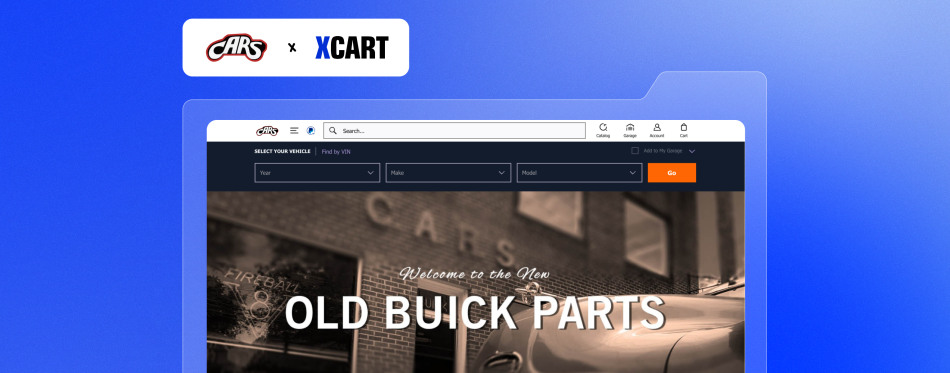

X-Cart is your partner in building a powerful, scalable eCommerce store tailored to your business goals. Whatever your vision, we’ll help turn it into a high-performing online storefront.

About the author