Even though it’s been around since 1999 and has 24 member states, many businesses have a lot of questions about the Streamlined Sales and Use Tax Agreement. On February 24, X-Cart hosted a webinar with our partners at Avalara, answering a ton of questions around nexus, SST, and even international tax rules. Watch the replay below. […]

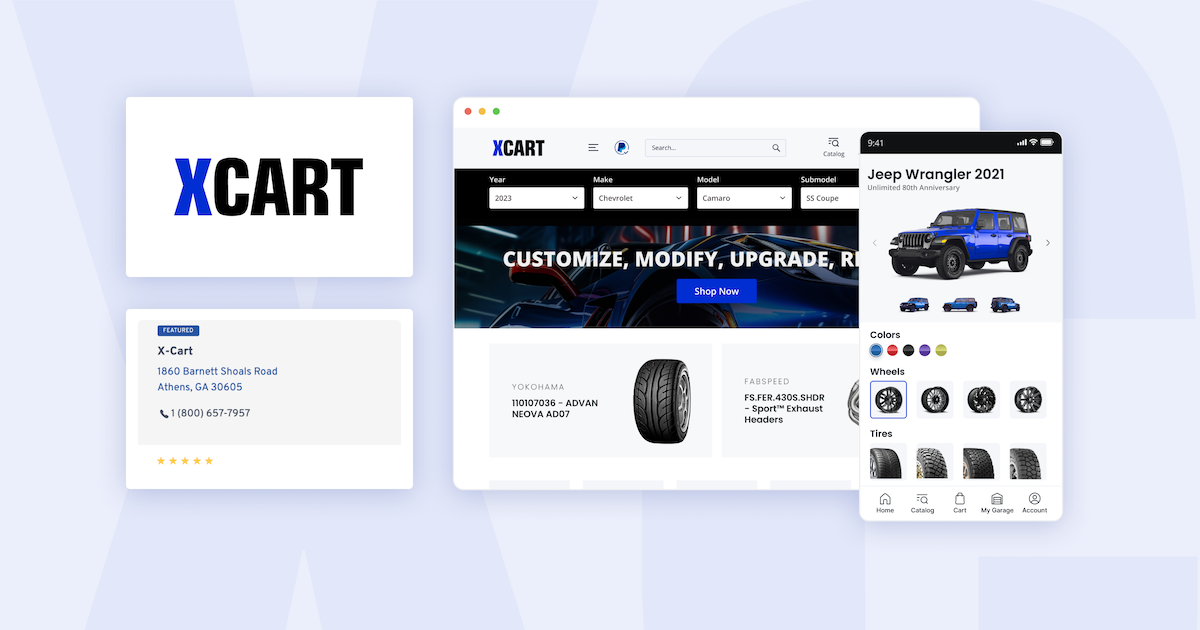

X-Cart eCommerce Blog

It’s a perfect place to discover tips on how to launch your online business and sell online virtually everything. From time to time, you’ll get updates on the shopping cart we develop with so much love.

Categories

All

Posts by Gail Cole

5 min read

X-Cart in the news

Subscribe to Our Newsletter

to Get Expert-Backed Tips Straight Into Your Inbox