Small or Medium-Sized Business? Jump These International Hurdles to Gain Cross-Border Commerce Revenue.

This blog post was originally contributed by Jamie James from PingPong.

A company no longer needs a massive customer base to be global. There are an estimated 30 million small and medium-sized enterprises in the United States.

All it takes to become a global company is to sell products to an international customer base. This type of global reach is what cross-border eCommerce is all about, and more and more online merchants are expanding globally to rack in more revenue that comes with selling cross-border.

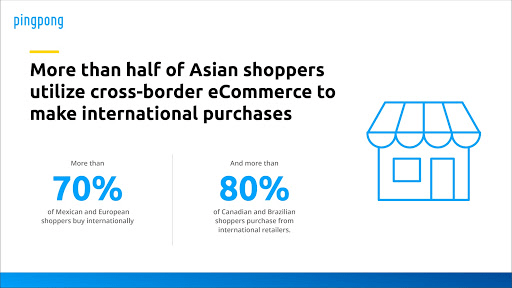

While consumers have long been purchasing more and more online, they’re also buying online from other countries. Nearly half of all U.S. shoppers now make purchases from international retailers, according to this UPS Global Executive Summary.

The numbers are even higher in international markets:

Numbers don’t lie. Cross-border eCommerce is the future of online and retail commerce.

People all over the world likely want what your small or medium-sized business is selling. Why not make it easier for them?

This article explores different challenges small and mid-sized businesses might encounter when taking eCommerce sales globally and options for navigating cross-border eCommerce. We’re featuring PingPong Payment Solutions — a game changer in cross-border eCommerce, online retail, and innovative payment services. Here’s everything online merchants, small, and medium-sized businesses need to know.

Getting a Local Bank Account

Online merchants are all too aware of this classic challenge: not having a local account in a certain country. This is a necessary aspect of doing business abroad.

But who wants to gather a ton of legal and business documents just to hop on a plane, fly around the world, and spend hours going through the process of opening local business accounts to conduct business abroad?

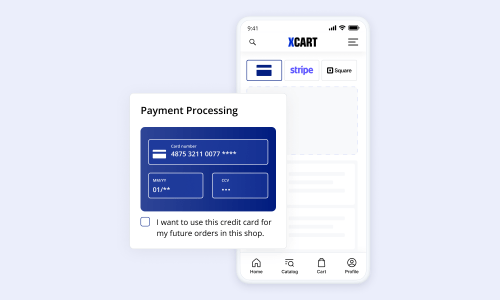

Payment specialists (like PingPong) exist that enable businesses just like yours to create virtual bank accounts.

It’s the same type of account you’d get if you lived in that country as a local. You apply for the account, receive a unique account number, and can send and receive domestic currency in those countries.

With money moving across borders, a virtual bank account of this type:

- Eliminates long delays for receiving and sending money and payments;

- The need for a local bank account;

- Saves your online retail business significant time and money.

Not to mention, your finance department will thank you.

They avoid the nightmare of having to learn and manage different online banking platforms, the reconciliation of funds, and inevitable accounting issues with money sitting in different places around the world.

Now that you know how easy it actually is to get an operating business account in the country you want to expand to, let’s explore some of the awesome things online merchants can do when it comes to cross-border eCommerce.

Currency Conversion: Hidden FX Fees

Are you giving hard-earned money away? The exchange rate is not a factor that a lot of online merchants think twice about when it comes to saving money on cross-border eCommerce. That’s because as a small or medium-sized business, once a marketplace platform pays you your profits in US dollars from global eCommerce sales, hidden fees have already been assessed.

Up until August, 2020, Amazon, for example, charged anywhere from 3% to 5% of the original sum to convert currencies for customers like you. This was an astonishingly high rate that most sellers and online merchants were either unaware they were paying (losing profits), or were under the impression the process was the only payment service available.

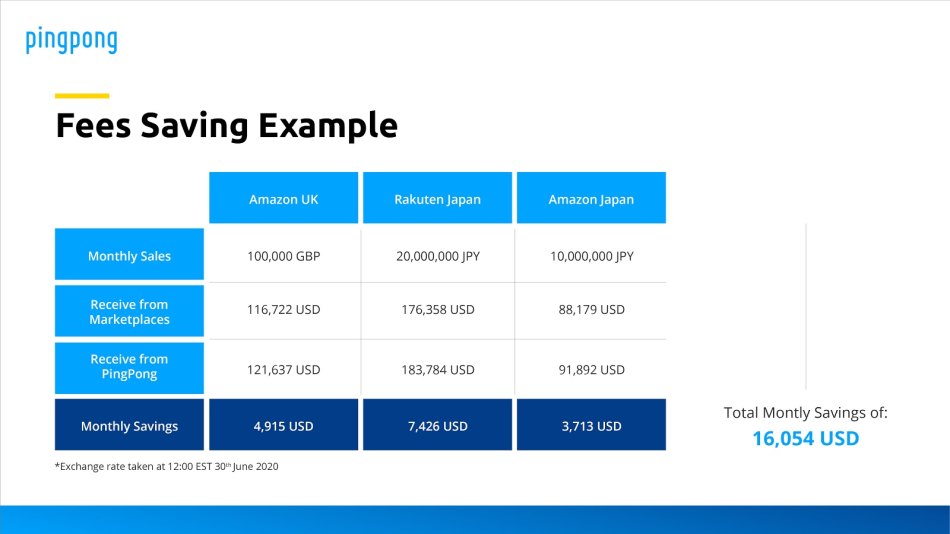

Look at the savings generated for these profits, after each marketplace has applied conversion fees:

**This example depicts what a US merchant would receive in profits after a marketplace has charged conversion fees vs. after PingPong had applied its 1% cost.

Naturally, your customer base will be purchasing your product and paying you in Japanese yen (Amazon Japan or Rakuten Japan), or GBP (pounds, Amazon UK). A given marketplace receives payments in the consumer’s local currency. When the time comes to pay your business its global eCommerce profits, the marketplace deposits US dollars into your business bank account – but they’d already charged the conversion fee.

PingPong Set the Industry Standard

We’ve never had to lower our rates because we made them awesome from the beginning.

Other marketplaces, banks, and financial institutions charge more for this service or have been forced to lower their rates to remain competitive. You have never paid more than 1% for this service as a PingPong customer.

Paying VAT

You can also make VAT payments in the foreign market’s currency without having to convert it twice – meaning you can use earnings from international marketplaces to pay VAT and remain compliant before those earnings are converted to your desired currency.

This makes things really simple and it allows online merchants to keep as much of their eCommerce sales as possible. Additionally, some virtual payment solutions enable businesses to choose when they convert foreign currency to their domestic currency.

Manufacturer Costs & Paying Suppliers

The money you receive from an international marketplace in your virtual account can be used to pay suppliers, invoices, and logistics companies in their domestic currency right from your PingPong account. No conversion fees. And definitely no double conversion fees!

Payment services and solutions exist (like Supplier Pay) to facilitate paying suppliers and vendors and save small and medium-sized businesses loads of money – sometimes avoiding conversion fees altogether.

Furthermore, your respective small or medium-sized businesses might stand to financially gain from shopping supplier rates or switching to a new manufacturing facility. If you can retain a greater profit margin using a supplier that can make your items cheaper at the same quality, why wouldn’t you?

With all the different things happening throughout the world, FX rates fluctuate drastically – sometimes on a daily basis. So the ability to control when you convert your cross-border profits back into US dollars is another opportunity for online merchants to save a significant amount of money.

Exploring ways of converting your eCommerce sales revenue from one currency to another under a much more favorable rate can also have a considerable impact on your cross-border profitability.

Language Barriers/Local Laws

Embracing opportunities to take eCommerce business globally means small and medium-sized businesses need to be open to pivoting when it comes to changes in emerging markets. Local laws, regulations, online trade rules, and language barriers are often primary obstacles that need to be addressed. This affects social media marketing, listing optimization, SEO, and your eCommerce marketing strategy in general.

Furthermore, local, professional translators can help with optimizing listings and other customer-facing content to greatly improve your customers’ experiences.

Check out these examples.

Japan Example

The English fluency level for a Japan customer base is low. Customers expect (and are more comfortable) doing their online shopping in their native language. If you don’t speak or write Japanese, this will directly affect your store operations, listings, and product descriptions.

These factors significantly impact your Japanese customer base. You’ll need to consider hiring a native speaker to optimize your storefront. Options:

- Translation companies abroad

- In-house Japanese speakers

- Freelancers (some dedicated to Rakuten)

This obstacle and proposed strategy isn’t limited to a Japanese customer base. There are a variety of ways to optimize online retail listings in foreign markets to meet the needs of local consumers.

Canada Example

U.S. Companies and individuals can expand their eCommerce online retail business activities in the Canadian marketplace through the Non-resident Importer (NRI) program.

Benefits Of NRI

- Simplified pricing. Your customer base gets price certainty because transportation costs, customs clearance fees, duties, and taxes are already included in the online sales price of purchased retail goods.

- No ‘surprise’ fees when imported goods pass into Canada.

- Competitive Advantage. Significant reductions in shipping options and costs create company savings that can be passed on to your customer base.

- Shipment Control. You control the shipping options door-to-door; NRI minimizes customs delays and allows you to track a shipment’s journey.

- Market Expansion. As an NRI, your company increases its global eCommerce market footprint to Canada, allowing your business to compete more efficiently with Canadian and U.S. competitors.

The Easiest Way to Become an NRI

Appoint a customs broker to transact business with the Canada Border Services Agency (CBSA) on your behalf.

Your broker will:

- ensure that your company is compliant as an exporter of imported goods to Canada,

- ensure that your business takes advantage of NAFTA benefits where possible,

- help develop a product’s final price (including duty, taxes, transportation, and brokerage fees),

- explain Canadian taxes,

- simplify documentation,

- establish your non-resident importer account and obtain a Canadian Business Number,

- sign a Maintaining Books and Records Outside of Canada agreement.

Keep in mind, your company is ultimately accountable for all matters, whether a customs broker is or isn’t appointed.

Shipping

While air travel is generally quicker and easier to track when it comes to imported goods, it may not always be the most cost-savvy solution, especially during times of global crisis.

Sea travel may be more cost-efficient for ordering imported goods or products in bulk but could take upwards of a month to reach your storage facility.

And if you’re using FBA or similar marketplace tools, be aware of the hidden costs. It’s your business revenue that eats them.

Find companies that specialize in shipping solutions the way that PingPong specializes in payment methods and customer service for online merchants. While research might take a little time, finding a solution that saves the business thousands of dollars in shipping options annually would be worth it, right?

Meanwhile, signing up for a PingPong account is quick, easy, and free. How much revenue are you going to save?

Weigh in: leave a comment and share ideas we might have missed or other questions you have about expanding internationally!

Anastasia has over 8 years of experience in the eCommerce industry. Having been a Customer Care agent in the past, she knows exactly what eCommerce merchants' needs are, and uses her knowledge in Marketing to bring value to the community by sharing her thoughts on relevant topics.