19 Tips to Beat Auto Parts eCommerce Fraud and Protect Your Site From Scammers

Less than 30 years ago, no one even knew what Google and online shopping were. And today, people not only fearlessly spend billions of dollars surfing through its pages, but also use it as a handy tool to find the best place to land on Mars.

According to Worldpay, by 2030, online payment volume is going to reach as much as $33.5 trillion in total. Fertile ground for fraudsters, isn’t it?

Yes. That’s why eCommerce fraud is growing rapidly, too, especially among auto parts eCommerce merchants, as the market is huge.

Despite the efforts of the eCommerce industry and the increased number of fraud detection software, these malicious hackers successfully attacked 84% of merchants in 2024 and stole $48 billion.

Chargeback fraud alone costs merchants more than $25 billion of their annual revenue. For every $100 chargeback, online merchants lose $308.

Can your business absorb significant financial loss? If not, it’s time to prioritize your automotive eCommerce security. Here’s what you need to know to protect your store from online payment fraud and other threats.

I. Types of eCommerce Fraud

Black baggy hoodie, sagging pants, aggressive behavior, and a huge gun behind the belt. Is that what a typical criminal should look like? Not necessarily, if we talk about cyber criminals.

It can be just a sharp-witted guy sitting on the other side of your laptop screen and making up tricky schemes to steal your credit card numbers or other personal and financial information.

For auto parts retailers, who deal with a mix of high-value items and specific customer behaviors, understanding the common threats and where they come from is the first step.

There are 9 types of eCommerce fraud that automotive retailers should look out for:

Credit Card Fraud

It’s the easiest way to attack merchants. Scammers use stolen credit card information for shopping online. Later on, the original card owner may seek reimbursement of expenses, which causes lost revenue and brand reputation.

Friendly Fraud

This one has nothing to do with your friends, unfortunately. It happens when a customer orders goods or services, pays for them, and then, all of a sudden or most likely not, changes their mind. They claim that their credit card has been stolen and deliberately initiate a chargeback after receiving the purchased goods.

Identity Theft, or Account Takeover Fraud

In order to commit identity fraud, one of the most common types of eCommerce fraud, a user carries out fraudulent purchases using a false name, fake accounts, and a stolen credit card.

Clean Fraud

Clean fraud sounds to me like dirty soap, as there’s nothing clean in it. This type of fraud usually involves thorough analyses of the fraud detection systems, performing card testing before stealing big, and a great deal of knowledge about the legitimate customer. It’s not the easiest task to detect clean fraud.

Affiliate Fraud

Another widely met type of eCommerce fraud is affiliate fraud, designed to glean more money from an affiliate program. It’s often connected to manipulating traffic or signup statistics.

Triangulation Fraud

Triangulation fraud is carried out, as the name suggests, in three steps.

- First, criminals create a fake storefront to collect credit card data and personal information.

- Second, this data is used for ordering real products and shipping them to the original card owners.

- Finally, the same credit card details are used for additional purchases.

Card Not Present Fraud

Card not present (CNP) fraud is about all fraudulent transactions carried out online or over the phone when a merchant cannot personally examine the stolen credit card for signs of possible fraud (i.e., missing hologram).

Refund Fraud, or Chargeback Fraud

Refund fraud refers to an overpayment, which is usually made on purpose. Claiming this credit card is closed, the owner asks to send money using alternative payment methods.

Phishing Scams

Scammers are becoming more & more resourceful to find ways to cheat a wider range of people with phishing attacks. They send a bunch of emails or texts to get you to share your sensitive personal or financial information. And a single data breach can lead to millions of dollars in consumer fraud costs.

Solution for Auto Parts eCommerce Merchants: Does It Exist?

In many cases, external eCommerce fraud prevention and management systems can be a perfect solution.

But when the fraudsters are especially smart and inventive, it’s only another human being who can single out a cyber criminal. That’s why every merchant should know at least the very basics of eCommerce fraud to be ahead of the game.

Here is the complete list of website fraud protection tips and recommendations that should save your eCommerce website from malicious activity and nip ubiquitous hackers’ attempts in the bud.

As you know, prevention is always better than a cure.

II. Ways to Fight Against eCommerce Fraud

If you’re new to fraud prevention, this list of nineteen tips will become a solid foundation for this new security initiative.

1. Monitor Your Online Transactions for Unusual Activity

Let’s put it straight.

Nobody knows your customers as well as you do or has invested as much time and money (together with blood, sweat, and tears) in it, so you are absolutely the best person to tell fraudulent transactions from legitimate ones. Most likely, you know your big spenders and their shopping habits.

For example, if one of your customers has changed their shipping address and is ready to pay extra to ship your products quicker than before, it means that someone has probably taken over their merchant account and is trying to cheat.

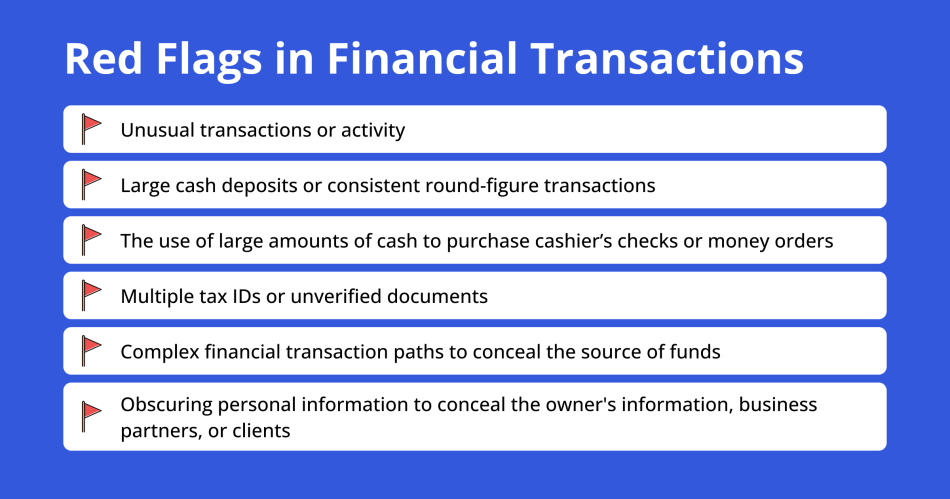

That’s why it’s important to monitor your transactions for red flags.

If the same person places multiple orders using different credit cards, it’s also quite suspicious. Or if the phone number they specified doesn’t match the area code of their billing or shipping address, that’s no good either.

If possible, configure system alerts for when suspicious activity or fraud occurs.

2. Make PCI Compliance a Priority

PCI-DSS.

This jaw-breaking abbreviation is unlikely to be new for you, even if you have no idea what it really means.

But no matter whether you know it or not, this Payment Card Industry Data Security Standard is not optional at all, especially for online retailers who handle card data.

What is more, a lack of PCI compliance may result in a fine of $5,000 to $100,000.

What’s that all about? Launched back in 2006, this standard was designed to help eCommerce businesses protect themselves and their customers from fraudulent transactions.

The good news is that you do not always have to care about it all. Modern eCommerce software for auto parts sales, such as X-Cart, is built to be PCI compliant. Using a compliant platform and payment gateway provider lowers your risk of a data breach and protects you from hefty fines.

3. Countercheck Your Site Security

Now that the most sensitive spot of your eCommerce website — the checkout — is fully secured from online fraud with PCI DSS, it’s high time to make sure that the level of your website fraud protection is also high.

There’s no use locking down your checkout without building a huge metal hedge around your whole website.

It’s like building a house and leaving a back door open, hoping that housebreakers will never enter it in the middle of the night. They will break in anyway if you don’t take your eCommerce security seriously. Thankfully, you’ve got a couple of effective methods to lock down your site:

- Install an SSL certificate to encrypt the data (e.g., passwords) passed from your customers’ browsers to your store and prevent your store from “man in the middle” attacks. Google loves HTTPS sites, so sooner or later, you’ll want to install this certificate anyway.

- Consider updating your passwords regularly.

- Think of hiring a security auditor who will check if there are any vulnerabilities in your eCommerce website.

- Try using monitoring software, such as OSSEC, that provides real-time fraud prevention.

4. Use Tracking Numbers and Require a Signature Upon Delivery

Negotiators know to never take things at face value. And they are right. No matter how good a person appears to be, they can always cheat on you.

The same perfectly applies to your eCommerce site. Claiming that you never received a package and then asking for a refund is a no-brainer… only if your eCommerce platform does not require tracking numbers.

Ironically, this type of fraud is called “friendly” — without being friendly to you, your purse, and your business at all.

Tracking numbers and a signature upon delivery will save you from chargeback fraud.

5. Stay Away from Sensitive Customer Data

If you have no data to steal, then scammers have no reason to rob you. Does it make sense? It does, especially when the question is the safety of your customers’ credit card data and personal information.

The best fraud prevention tool here is just getting rid of all that sensitive data.

But what about recurring payments? In this case, there’s no other alternative for you but to deal with PCI-compliance requirements and storage guidelines.

Luckily, you can use X-Cart Pay to safely and conveniently store your customers’ credit card information. This addon is a handy tool for processing new orders, reorders, and recurring payments.

It’s like your shark-proof cage in the deep ocean of eCommerce fraud — sharks are rushing around it, feeding their eyes on you, but unable to catch their trophy.

6. Educate your Staff on eCommerce Security

Using automated fraud prevention tools is a good practice, but it’s not safe to fully rely on them.

Your employees should also be aware of fraud risks and regularly receive anti-fraud training. Pay attention to the passwords they use daily and whether they’re falling into the “0987654321” or “QWERTY” traps.

Teach them to uncover potential red flags and implement the right fraud detection techniques. One soldier won’t make the battle against fraud. Consider educating those with whom you are working.

7. Learn from Experience

Experience is the biggest golden brick in the world, that’s true. When you fall into a ditch hundreds of times, bruised all over, you’ll build a bridge or a safety net so you won’t be hurt once again next time.

What I mean here is that creating and maintaining a file of past fraudulent transactions and attempts is always a good idea. Fraud protection is possible when you take necessary precautions and keep a record of what’s going on in your business.

Should your system ever be hacked or compromised, record the unfortunate event in your black anti-hacker notebook. You’ll be able to use that file to compare with future transactions and thus improve your website security.

You may notice that fraudulent activity comes from certain countries, unusually large orders, and shipping addresses that don’t match the billing address.

Having a grudge-holding personality is not that bad, isn’t it?

8. Create Super-Strong Passwords and Force Your Customers to Do the Same

“12.03.1985”, “password”, “nickiloveyou”…

People are lazy password-creators, and hackers know that.

And despite several large-scale data breaches, not much has changed today. It looks like people just can’t learn the lesson and still take website fraud protection for granted. If your password is also easy to guess, why not make it just “HackMe”?

The following steps may be the best strategy to reduce online fraud risk and save your auto parts online shops from almost all types of fraud:

- Create passwords that are at least 10-12 digits long.

- Use combinations of different characters, numbers, and letters (for example, “F1gur471v3ly 5p34k1ng” — did you guess what is written here?).

- Do not share your passwords with employees.

You don’t have to write all your passwords down or keep changing them once a month — password managers such as Dashlane, KeePassX, or RoboForm will save all the time you spend filling out forms and logging into websites.

9. Set Limits on Purchases

Imagine a Jon Johnson, who has never ever bought anything in your online shop, has just made a humongous order.

Doesn’t it look suspicious? It does, as this formidable purchase can be nothing more than fraud, which can eventually lead to massive chargebacks.

Setting the limits for the number of purchases or the total sum you can accept from one person in a single day can be a good solution.

If some evil-minded person comes to your eCommerce site and tries to buy 365,200 bolts for their two cars, you’ll be immediately notified.

This way, you’ll be given a chance to manually review transactions, and a criminal might be scared away.

10. Use AVS to Check Billing Addresses of Your Customers

Address Verification System (AVS) is another proven tool to help prevent fraudulent credit card purchases. It is used to verify if the billing address of a person matches that of the address on file for the credit card.

For example, if an Indonesian cyber gangster tries to use a credit card of a guy living in Canada, the system will immediately trigger a warning for you.

The AVS option is usually included in most payment processing solutions, like PayPal, Skrill, or Stripe (all of them are available on the X-Cart Marketplace).

Ask yours if they support this feature or not, and enable it if they do. Even if it costs extra, don’t be penny-wise but pound-foolish.

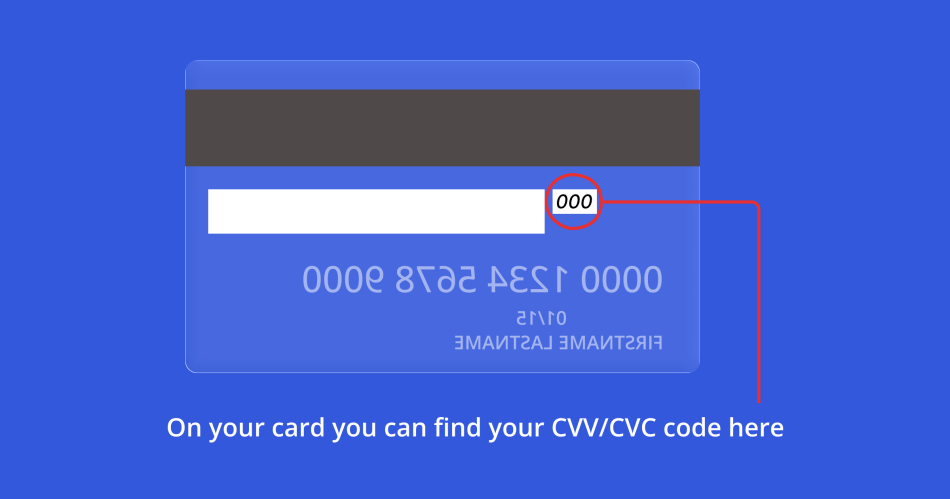

11. Use Credit Card Security Codes

Have a look at the back of your credit card. There you will find a three (in some cases, four) digit code that gives you an extra level of security.

Master Card calls this code CVC 2, VISA — CVV2, American Express refers to it as CID, and Discover calls their code CID2.

Despite different names, all these codes serve the same function — they help you avoid online fraud and identity theft.

PCI rules prevent online retailers from storing these CVV/CVC/CID codes. That’s probably why it’s extremely hard to steal them without stealing the physical credit card. And that’s why they are so effective in preventing eCommerce fraud.

12. Always Have a Back-Up Plan

Though payment fraud and phishing do not usually cause any problems for your website, they can only affect your money and personal information; you should be prepared for a disaster. And even if you think your eCommerce site is bulletproof, chances are that it can be hacked.

In this case, you may need to restore your eCommerce site to a working condition from backup files.

X-Cart has a useful tool for that — Backup Master — it creates a copy of your MySQL database, website files, and compresses it into a single ZIP file. So, if anything terrible happens, you can be sure that this addon will back you up.

Also, talk to your hosting provider — all good guys do regular backups of their clients’ stores. By the way, X-Cart hosting is a good guy 😉

13. Try an Automated Anti-fraud Solution

Your eCommerce shopping solution and hosting provider may also have some fraud detection techniques in store for you.

In addition to 100% PCI-DSS compliance, X-Cart offers a pack of other useful security features for your store, such as:

- HTTPS/SSL support for secure connections and safe checkout, cryptographically strong SHA-2 sensitive data encryption;

- XSS- and CSRF-attack protection, protection against SQL-injections, meaning that each query to the DB is secure and all the variables are being checked;

- Failed login attempts notifications;

- Database backup and restore feature;

- Two-factor authentication adds an extra layer of security to your store

Such fraud prevention tools as Kount, NoFraud, or Signifyd can also help you save your store from scammers.

14. Keep Platforms and Software Up to Date

There’s nothing that cannot be improved, and that’s especially true for software and applications. As time passes, we implement new features, reveal and patch vulnerabilities, and make the interface more friendly for users.

Thus, bit by bit, our software is getting closer to perfection.

For example, X-Cart is known for its easy upgrades.

That’s why 62% of our users keep their software fresh and regularly install major updates between branches. Minor ones, within the branch, with bug-fixes and the latest security patches, are installed by 80% of users.

Moreso, if you host your eCommerce site on secure hosting from X-Cart, you are as safe as the Bank of England, as you can enjoy automatic security patches and effortlessly weed out viruses.

Think of it and make sure you are running the latest version of your eCommerce platform, fresh and shining, immune to hacking attacks and other types of internet nasties. And we will help you if needed.

15. When in Doubt, Eighty-six It

When a red flag goes up, it’s always worth giving an order a closer look. But think twice before blocking a suspicious user. It can be your future heavy buyer, or a friend of your friend, who looks just a little bit shady.

For example, eBay has rather strict fraud management rules in place. So strict that they regularly brush away even legitimate transactions and get negative feedback from innocent customers. That’s good for combating eCommerce fraud, but it can be disastrous for customer relations.

Try to find an excuse to speak with the cardholder — you can request the details of the order or ask him a couple of questions. Shoppers using stolen credit cards rarely provide a real phone number, so you will hardly get through to them.

16. Double-check if the IP Address and the Credit Card Address Match

Yes, sometimes shoppers make purchases while traveling. But usually, these are some small items. No right-minded person will travel miles away from their country to order a new refrigerator for their family.

So double-check the IP address, shipping, and billing addresses. Ideally, they should belong to the same location.

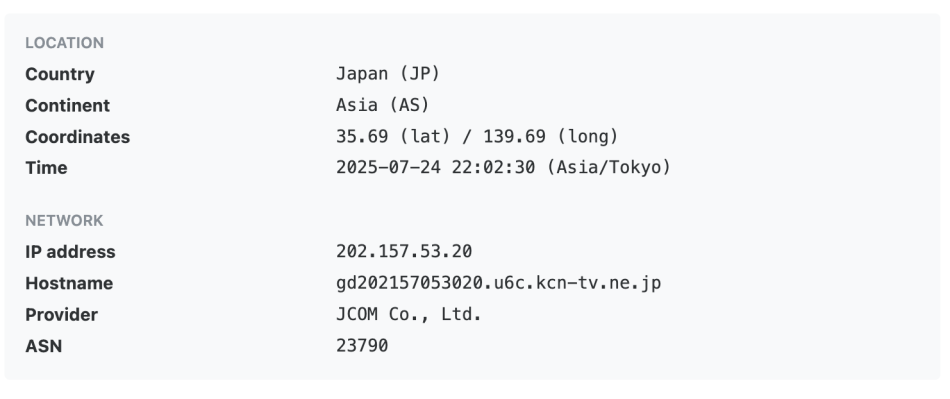

Let’s see. You’ve got an order from Canada. Billing city is Toronto, and shipping city is New York. Someone living in Canada is going to send a gift to his friend in New York. Everything looks fine, but the IP address is 202.157.53.20.

Let’s Google it.

The IP address belongs to JCOM Co., Ltd. (Tokyo, Japan).

Doesn’t that seem strange to you?

The IP address from an anonymous web proxy service is yet another reason to worry about.

Keep a close eye on things like that.

17. Brush Away Non-Physical Shipping Addresses

Though wearing a mask and a black hood won’t save cyber criminals from being noticed, these guys do their best to remain invisible online and offline.

Some of them assign PO boxes and drop shipping locations so that the package arrives anywhere but a real physical address.

That’s a well-thought-out plan for a scammer. And that’s a sure-fire sign of online fraud for a merchant.

You might just save yourself a lot of headaches if you deliver your products only to physical addresses. If you combine this delivery with a required signature, that would be a safer way.

No friendly fraud. No fraud risks.

18. Take Another Look at Quickly Shipped Items

“I want it all, and I want it now” — that’s what the guys from a famous British rock band Queen broadcast to the world back in 1989.

You won’t believe it, but the same thoughts pop into fraudsters’ heads as well.

They do not shy away from the opportunity to overpay for expedited shipping — the sooner they get your products, the faster they will let you know that the item they ordered was “lost in transit”.

Keep in mind that orders with expedited shipping (especially if the shipping and billing addresses do not match!) are signals of eCommerce fraud.

A simple check could be all you need to protect your eCommerce store from another fraudulent transaction.

19. Handle Orders from Suspicious Email Addresses

Do you think it’s OK to accept an order from hdsds89ddsg$jhsgd@yahoo.com kind of email?

Not for me.

The guy hiding behind this mailbox must have a very fertile mind to make up such a sophisticated name for their mailbox. Or it may be just a random sequence of letters, which is more probable.

Anyway, this order should strike you as suspicious. The email looks like a temporary one, so if you come across things like that, double-check the shopper’s identity, or block them right away, as they are a 99,99% thief, ready to fool you around.

Bottomline

Don’t let hackers steal your holy eCommerce grail.

If their attempt is a success, along with losing the money, you will also say goodbye to your perfect reputation, lose loyal customers, and sales. And to finish you off, Visa may pay a visit, after which you pay penalties. And it’s not fun at all, at least for a merchant who feels furious, or upset, or both.

Hope these tips will help you fight against these bad guys and move your website fraud protection to the upper level.

Hold the fort!

P.S. (some funny stuff)

Can anyone tell the difference between ‘Completed’ and ‘Finished’? No dictionary has ever been able to define the difference between ‘Complete’ and ‘Finished.’ However, in a linguistic conference held in London, England, Thulaseedharan B, an Indian British, was the clever winner.

His response was: “When you marry the right woman, you are ‘Complete.’ If you marry the wrong woman, you are ‘Finished.’ And, when the right woman catches you with the wrong woman, you are ‘Completely Finished.'”

The same applies to fraud prevention. Make sure you’re complete before you discover you’re finished!

Need a secure eCommerce platform to sell auto parts?

FAQs

What are eCommerce frauds?

Think of it as any kind of sneaky, dishonest trick someone uses to get money or goods from an online store or a shopper. It’s basically online shopping’s version of getting pickpocketed.

What kind of fraud makes up 70% of eCommerce fraud?

The big one is payment fraud. This is where fraudsters use stolen payment information, like credit card numbers, to make purchases online.

What is an example of online fraud?

Imagine a scammer gets your credit card details and uses them to buy a brand-new laptop from an online store. They have it shipped to a different address, and you’re left with a bill for something you never bought. That’s a classic example.

What is identity fraud in eCommerce?

This is when a scammer pretends to be you. They might use your name, address, and other personal details (not just your credit card) to open new accounts or make purchases, causing all sorts of problems in your name.

What is the most common type of eCommerce fraud?

By far, the most common is credit card fraud, which falls under payment fraud. It’s the go-to method for most online scammers because it’s fast and, unfortunately, pretty effective.

What are the three types of frauds?

While there are many kinds, they often fall into three main buckets:

- Chargeback fraud (or friendly fraud): This is when a real customer buys something but then tells their bank the charge was fraudulent to get their money back, even though they received the item.

- Identity theft: This is the scary one where someone steals your personal info to go on a shopping spree, pretending to be you.

- Phishing: This is when fraudsters trick you into giving them your login details for a shopping site, then take over your account to make purchases.

About the author