You Can Now Offer Affirm Payment Plans to the U.S. and Canadian Online Shoppers

As an online business owner, you always strive to optimize the buyer journey and make it more convenient, and the checkout experience is the most critical part. The “must-haves” of a smooth checkout process include user-friendly UI and UX design, various shipping options, and a wide range of payment methods.

Diversifying your payment options with flexible payments, aka Buy Now Pay Later services (BNPL), can be a good idea. Unlike traditional credit cards, the BNPL concept offers more customer-friendly, personalized payment plans, allowing buyers to get the purchased item right away but pay for it at their own pace. At the same time, online merchants get the total amount upfront, which helps to avoid headaches with delayed payments.

At X-Cart, we’ve seen firsthand how big the demand for flexible payment options is among online businesses (and their customers!). Therefore, we keep fostering our partnership with Affirm, a ‘Buy now, pay later’ service that offers flexible loans to help expand your customer base and increase average order value.

We are excited to announce that Affirm has extended to Canada, enabling online merchants to offer flexible payment plans to their customers across North America.

Read on as we uncover the Affirm benefits for online sellers, cover its main features, and drill down into details on connecting the Affirm add-on to the X-Cart store.

Why Affirm?

Pay-over-time services keep winning affection among online store owners and their customers due to their undisputable convenience for both sides. Flexible payment options offered by Affirm are no exception. According to Similarweb, Affirm loans retain the # 3 spot among the most commonly used Buy Now Pay Later companies in 2022, such as Klarna, Afterpay, or Sezzle.

Affirm offers flexible loans and personalized payment plans, allowing shoppers to spread payments over various term lengths. Depending on the term length, loan amount, customer’s payment history, and eligibility, the Annual Percentage Rate (APR) can vary between 0% and 30%.

Affirm’s mission for online businesses is to deliver honest financial products that improve lives. By building a new kind of payment network based on trust, transparency, and putting people first, they empower millions of consumers to spend and save responsibly and give thousands of businesses the tools to fuel growth. Unlike most credit cards and other pay-over-time options, we show consumers precisely what they will pay upfront, never increase that amount, and never charge any late or hidden fees.

The Main Benefits of Affirm for Online Businesses

According to First Small Business, making purchases that don’t fit their budget is the top reason consumers use BNPL services. At the same time, businesses offering BNPL see a 2% increase in converted visits compared to companies that don’t provide customer financing options, which see an 11% drop in conversions.

While customers feel safe and confident in controlling their budget, online merchants benefit from their loyalty. In terms of eCommerce, this translates to higher conversion rates, expanded customer base, and increased average order value.

So, here’s a quick overview of the main benefits that your eCommerce business will enjoy with Affirm.

Main Affirm benefits for eCommerce businesses:

- Advanced customer acquisition strategy

- Higher conversion rates

- Increased AOV (Average Order Value)

- Boost in overall sales

- Decreased cart abandonment

- Powerful marketing opportunities

- Improved customer loyalty

- Seamless integration with eCommerce platforms

- Competitive advantage over the sellers that do not offer BNPL at the checkout

Affirm for Business: Features and Tools

Known for its client-oriented approach, Affirm comes up with various handy features for shoppers and sellers alike. Whereas a streamlined and automated payment process makes the online store’s performance transparent and easy to leverage, it also plays the first fiddle when it comes to customer loyalty.

Thus, we’ve put together its most prominent features designed for online sellers to show you how Affirm can level up your online business. Plus, we’ve mustered up a bonus pack of tools intended for customers that also implies some extra value to merchants.

Affirm Features for Online Sellers:

- Merchant dashboard. Affirm dashboard provides a robust user interface. Through this interface, each online seller can view transaction data, manage charges, access API keys, and configure the merchant’s Affirm account.

- Brand-sponsored promotions. Affirm can help large, diversified online merchants create brand-specific promotional financing offers and maximize their bottom line. This is possible when the online sellers’ suppliers initially fund promotions. Whereas suppliers cover the costs of the lowered APR for their products, online merchants gain a powerful alternative to markdowns, as they can increase sales without impacting their margins. At the same time, suppliers can sell through additional volume.

- Flawless integrations with eCommerce platforms. All in all, Affirm partners with 47 eCommerce website builders, such as X-Cart, OpenCart, BigCommerce, and Shopify, to name a few.

- Flexible marketing capabilities. With a powerful Affirm marketing toolkit, you can include the details about Affirm in your marketing content across the website, from social media posts announcing the Affirm partnership and landing pages with specific interest-free financing offerings to seasonal email campaigns and abandoned cart reminders offering the pay later option.

Affirm has seen firsthand that online merchants can significantly improve customer engagement and maximize their bottom line with the right marketing tools. A major player in the aftermarket auto parts and accessories industry, SuperATV discovered a 333% increase in Affirm sales volume after incorporating Affirm messaging on product display pages.

Quick Summary: Besides a flexible and transparent online store checkout, online merchants gain valuable insights into their customers’ shopping behavior via enhanced analytic tools. On top of that, their brand’s appearance in the Affirm app can unlock many ways to grow revenue and continuously drive traffic through integrated campaigns, social media, and email marketing.

Affirm Features for Online Shoppers

Affirm keeps developing brand-new features and services designed to meet buyers’ needs and help online merchants deliver the outstanding customer experience.

1. Adaptive Checkout

As always, in the case of Affirm, customers never pay more than they agree to upfront and are not charged any late or hidden fees while being offered an optimized and personalized set of payment options.

Benefits from an online seller’s perspective: By pairing monthly installments with 0% interest promotions, online sellers can attract more customers. They can also use target promotions across their entire inventory or on particular products to boost conversion rates and grow incremental sales without giving discounts.

2. Debit + Card

The new Affirm Debit + Card enables online shoppers to pay upfront, like with an everyday debit card, or split eligible purchases over $100 into four interest-free payments. In addition, Debit + empowers users to pay for purchases instantly and earn cashback rewards.

Benefits from an online seller’s perspective: With Affirm, you can leverage SKU-level data to understand what a specific consumer is buying or interested in, the time of day they are buying something, and which marketing channels lead to a purchase. This will generate real insights for the merchant because they can identify the most effective ads and how to target current or potential customers better.

3. Affirm Super App

In the new, improved Affirm App, your customers can see their Affirm snapshot, including the amount spent and the outstanding payments. They are also empowered to earn cashback rewards and shop exclusive offers tailored to their shopping preferences.

Side note: Affirm also rolled out its Chrome extension that allows online shoppers to buy online using Affirm right from their desktop while managing their Affirm loans just like they do via the Affirm portal or the app.

Benefits from an online seller’s perspective: Online merchants can access the Affirm consumer base via the Affirm app, which provides personalized offers based on consumers’ spending patterns, shopping habits, and purchase intent. On top of that, they can take advantage of the bump in the customers’ purchase activity backed by the security, convenience, and ease of use that the Affirm App provides to its consumers.

How to Start Offering Affirm in Your Online Store

Affirm works with online businesses of various sizes and across multiple industries. To be eligible, an online entrepreneur should sell directly to U.S. or Canadian consumers, have a U.S. or CA bank account, a website in English, and prices listed in USD/CAD.

Once you meet the Affirm eligibility requirements, you should complete an application and create an account.

Online sellers also specify their average order value, annual revenue, and the eCommerce platform, along with basic information, such as company name, phone number, and email. Typically, it takes Affirm one to three business days to approve the application.

Affirm Integration with X-Cart

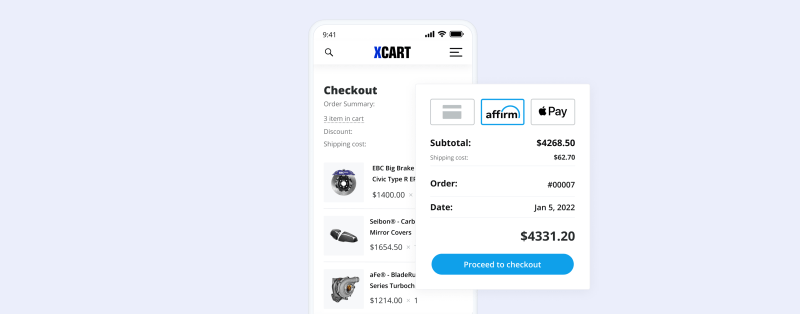

Affirm offers plenty of simple integrations with popular eCommerce platforms, and X-Cart is among them. To start using Affirm, connect it to your shopping cart solution with the out-of-the-box add-on or via direct API integration. We already have a ready-made plugin at X-Cart, so all you have to do is find it in our App Store.

With the X-Cart and Affirm integration, you can connect your website to Affirm in a few clicks and then enable and configure it with no coding skills required.

Quick Note: online merchants pay no integration fees, nor do they pay annual or monthly fees for using Affirm services.

With the X-Cart and Affirm integration, online merchants can access a full suite of features and thus offer their customers flexible pay-over-time options.

Key Perks

- Accelerate customer acquisition by knocking down the price as a barrier.

- Enhance customer engagement opportunities by enabling Affirm promotional messaging at every phase of the shopping journey.

- Manage and process Affirm charges in your order management system

Affirm integration is compatible with X-Cart store version 5.4.1 or above and can be effectively implemented within all the X-Cart solutions: Platform, Automotive, and Marketplace.

If for whatever reason you prefer not to burden yourself with the add-on setup, you can reach out to our technical support team and let them do the heavy lifting for you.

FAQs

Affirm is considered safe for both customers and merchants. The company has an A+ rating with the Better Business Bureau and an 86% Excellent rating on Trustpilot. However, Affirm transactions don’t offer the same consumer protections as credit card transactions.

Yes. As of August 27, 2021, Amazon is partnering with the Affirm financing provider to offer a BNPL checkout option on its U.S. marketplace. So now you can use Affirm payments as part of your multi-channel sales strategy, attracting more customers to your Amazon Product listing and encouraging them to buy from your eCommerce website.

Affirm will transfer the funds to your bank account via ACH transfer within one and three business days following each transaction. While customers spread out the purchase price over several weeks or months, Affirm pays merchants in full upfront.

As of May 2021, Returnly is a part of Affirm Loan Services, LLC, helping online merchants conduct seamless product returns and exchanges. Returnly’s offerings are designed to help merchants drive higher repurchase rates, increased revenue from returns, and higher customer satisfaction.

With applications such as Affirm, online sellers can selectively offer custom financing programs to shoppers based on product or cart attributes that are defined in their eCommerce platforms. The terms and conditions for any financing program determine interest rate range, loan term length, and merchant fee (MDR), which are agreed upon by Affirm and online merchants. Please contact Affirm Client Success team to know whether you qualify for custom financing programs: merchanthelp@affirm.com

Yes. Even though Affirm performs a soft inquiry of its borrowers’ credit histories that doesn’t show up on their credit reports, it can still affect the credit scores of their customers. Affirm currently reports some loans to Experian and may report to other credit bureaus in the future. Accurate and timely payments can help online shoppers build their credit history, whereas late payouts can hurt their credit scores.

Bottomline

Integrating Affirm into your online store’s payment options can be highly beneficial. With X-Cart and Affirm working as a killer combo, you can offer financing options to make larger purchases more accessible to your customers and improve your brand credibility, thus increasing your conversion rates. And this is definitely worth considering.

Ready to add Affirm to your online store checkout?

Payment options through Affirm are subject to eligibility, and are provided by these lending partners: affirm.com/lenders. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to California Finance Lender license 60DBO-111681.