X-Cart’s 2025 in Rearview: From Clean Data to Project Builds, Plus the 2026 Auto Trends We’re Watching

If 2024 was the year the automotive aftermarket finally caught its breath, 2025 was the year we got back to work — and realized the work had changed.

Looking back at the conversations we’ve championed this past year, a clear story emerges. We moved past the basic how-to of setting up an online store and started tackling the deeper mechanics of running a modern automotive business. We talked about both: selling parts and solving the friction that stops those parts from moving.

Here is how we saw the year unfold, and where we believe the road leads in 2026.

The 2025 Recap: Building Your Modern Aftermarket Store

We started the year focused on the unglamorous but critical foundations of eCommerce and ended it by challenging the very way our industry thinks about the customer journey.

1. Cleaning Up the Garage

Early in 2025, we focused on the backbone of our industry: Data. We know that fitment is the single most expensive word in auto parts — get it wrong, and you pay for the return shipping.

We moved away from the idea of data as just spreadsheets and toward product information management as a customer experience tool. The highlight of this effort was our deep dive with ICI (Innovative Creations Inc.). Their journey from data chaos to a streamlined, consumer-facing catalog was a blueprint for how legacy brands can digitize without losing their soul.

2. Solving the High-Risk Cash Flow Problem

As the year progressed, we tackled a frustration that plagues too many of you: being labeled high-risk. It is an outdated stigma that penalizes you for selling high-ticket items like crate engines or transmissions.

We spent a lot of energy this year discussing how to stabilize cash flow. The focus wasn’t on lower fees only, but on integrating secure virtual terminals that handle the complex reality of B2B and phone orders. We wanted to prove that selling expensive parts isn’t a risk — it’s a specialty.

3. AI as the Digital Counterman

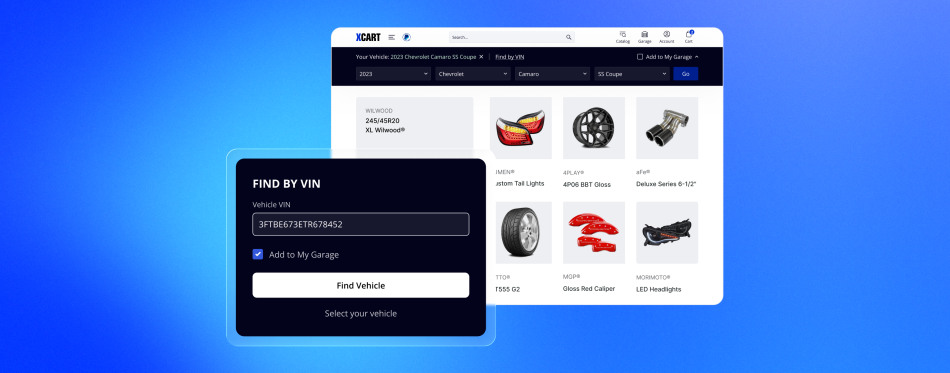

By mid-year, the AI conversation matured. We stopped asking “Will AI take our jobs?” and started asking “Can AI help us upsell?”

We explored how predictive search and dynamic pricing can act like a veteran counterman. In 2025, we saw AI tools that recognize a user’s browsing habits to suggest the belt and tensioner that likely need replacing, too.

4. Project-Over-Part-Mindset

We closed the year with one of our strongest strategic pivots yet. During the pre-holiday rush, we challenged merchants to Stop Selling Parts. Start Selling Projects.

The logic was simple: customers aren’t buying a lift kit; they are buying an overland adventure. We pushed for bundling strategies — like The Track Day Prep Kit — that solve a customer’s entire problem at once. This shift from transactional retail to solution-based selling defined our approach to the 2025 holiday season.

What About the Product?

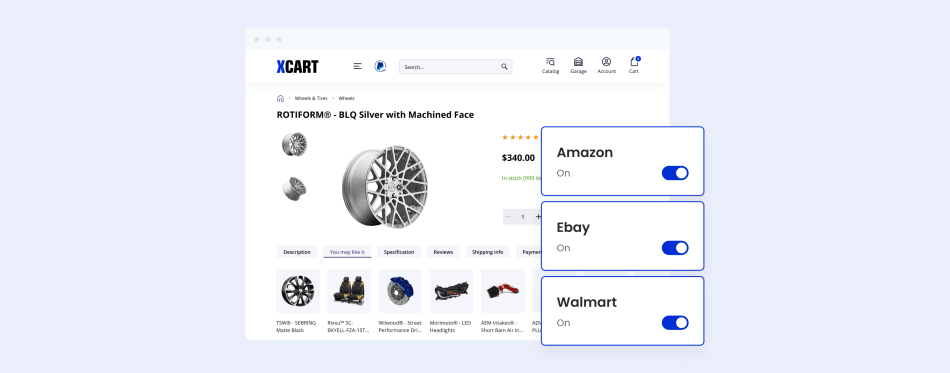

Strategy is nothing without the engine to run it. While we were discussing trends, our engineering team was busy under the hood. 2025 brought three major platform evolutions designed for the complexities of automotive retail.

Logistics Overhaul: X-Cart 5.6.0 Beta

In October, we launched the 5.6.0 Beta, which was a direct response to a common automotive pain point: distributed inventory. We know many of you don’t ship from a single garage; you ship from multiple warehouses and drop-ship partners.

We introduced Intelligent Order Routing. Now, the system automatically minimizes split shipments and routes orders to the warehouse closest to the customer. Combined with the new Inventory per Location feature, you finally have a bird’s-eye view of exactly what is in stock at every specific facility, not a generic total.

Speed of Checkout: Fastlane by PayPal

Auto parts buyers are often DIYers covered in grease, holding a phone, needing a part now. They don’t have time to remember passwords.

In May, we rolled out Fastlane by PayPal. This removed the friction of account creation. By allowing customers to check out with a one-time passcode that autofills their shipping and payment info, we helped merchants reduce cart abandonment during that critical checkout phase.

Recovering Lost Revenue: 71lbs Integration

Shipping heavy parts — exhausts, rotors, tires — is expensive, and late deliveries hurt your reputation. Back in March, we introduced the 71lbs FedEx & UPS Addon. The premise is simple: if a carrier is late, you are owed a refund.

71lbs automates this claim process. For our high-volume automotive merchants, this has meant recovering thousands of dollars in lost shipping spend without lifting a finger, plus gaining access to better negotiated carrier rates.

2026 Automotive Industry Predictions

As we look toward 2026, the industry is entering a phase of pragmatic futurism. The hype is settling, and the market is stabilizing around affordability and smarter tech. Based on the data we are seeing, here is what is coming down the road:

1. Used Market is the Aftermarket’s Gold Mine

Affordability remains the biggest hurdle for new car buyers. With new vehicle sales stabilizing, the real action in 2026 will be on the used lot. A massive wave of off-lease vehicles is hitting the market this year, projections show hundreds of thousands of additional units compared to 2024.

What it means for us: This is the sweet spot for the aftermarket. Second and third owners are the ones who repair and modify. Expect a surge in demand for maintenance parts and refresh upgrades (like infotainment retrofits and seat covers) as people buy used and aim to make it feel new.

2. EV Reality Check & Solid-State Shift

The “EV or bust” narrative is maturing into a complex mix of technologies. While EV market share in the U.S. is projected to grow up to 10%, the tech under the hood is changing.

- 2026 is the year we expect solid-state batteries to finally move toward commercial viability (keep an eye on Toyota and CATL). These promise to solve the range anxiety that stalled adoption in 2025.

- However, for the immediate future, we see hybrids (PHEVs) bridging the gap. For parts sellers, this means maintaining a complex inventory that caters to both ICE (Internal Combustion Engine) and electrified powertrains.

3. Software-Defined Vehicle (SDV)

In 2026, the car officially becomes a software platform. The differentiation between brands will move from horsepower to processing power.

We are seeing manufacturers lock features behind software walls, offering horsepower boosts or advanced driver-assist systems as monthly subscriptions. For the aftermarket, this presents a new challenge: Right to Repair will increasingly become Right to Access Data.

4. Supply Chain: The Rise of Digital Twins

Finally, the backend is getting an upgrade. We are seeing major manufacturers use digital twins — digital replicas of their entire logistics network — to run what-if scenarios.

Ideally, this means 2026 will see fewer of the catastrophic backorders that plagued our industry previously. A more predictable supply chain allows you, as merchants, to manage inventory with confidence rather than fear.

Let’s Build 2026 Together

The year 2025 was about cleaning up our data and changing our mindset from an automotive retailer platform to a tech partner. The upcoming 2026 is about helping you to capture opportunities in a recovering used market, navigate the hybrid transition, and polish your sales strategies.

Whatever market changes are coming, the X-Cart team is dedicated to providing you with a platform that keeps up with the trend.

The garage is open. Let’s get to work.

Need a platform for selling auto parts that understands where the industry is heading?

About the author