Top 15 eCommerce Payment Gateway Solutions for Your Auto Parts Store

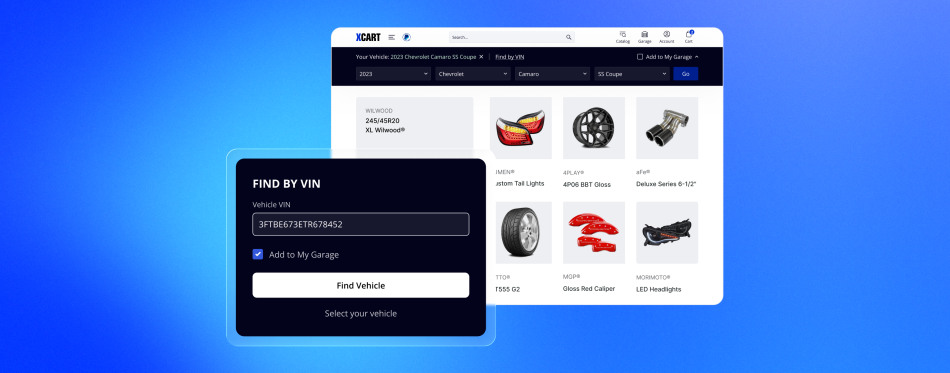

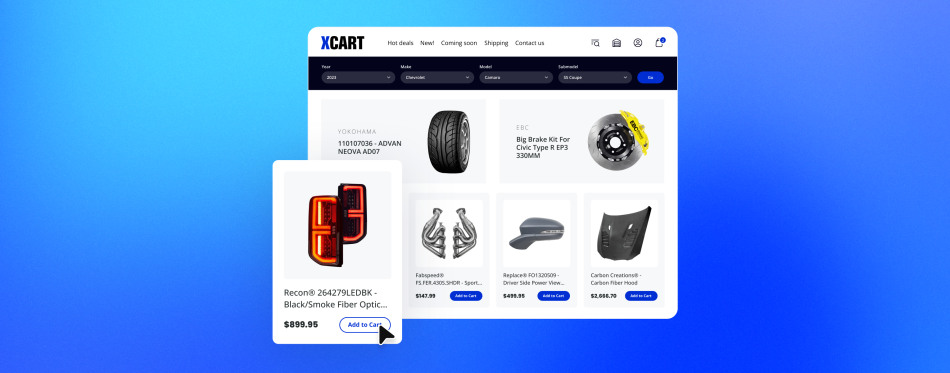

When you run an online auto parts store, you know your customers need two things: the right part and a smooth way to pay for it. A clunky, untrustworthy checkout can kill a sale faster than a stripped bolt. Your customers deal with high-value items, from custom wheels to entire engine assemblies, so trust and flexibility are key.

Choosing the right payment system is a big decision. You need security for those big-ticket sales, options for your customers, and a system that won’t give you a headache. The good news? With X-Cart, you have a garage full of powerful tools ready to bolt on.

Let’s pop the hood on the best payment solutions you can integrate into your X-Cart store.

1. X-Cart Pay

Tired of complicated setups and surprise fees? We built X-Cart Pay just for you. Because it comes from the team that built your store, it works perfectly with your X-Cart setup right out of the box. No more dealing with different systems or chasing down support from a company that doesn’t understand your business. We designed it to be simple and secure, so you can focus on selling parts.

When an issue pops up, you have one team to call. There’s no finger-pointing between your cart software and your payment processor because we are both. This unified support simplifies troubleshooting and gets you back to business faster. It’s about making your life easier, with everything from payments to reports managed inside the dashboard you already use every day.

- Best for: X-Cart store owners in the US who want a simple, fully integrated, and secure payment solution with clear, flat-rate pricing.

- Pricing: We believe in honest pricing. X-Cart Pay offers a simple flat fee, so you’ll always know what you’re paying. No confusing bills or hidden charges.

- Ease of use: It doesn’t get easier than this. The setup is a breeze, and you can manage all your payments and reports directly from your familiar X-Cart dashboard.

- Vital features: Accepts all major credit/debit cards, Apple Pay, and ACH bank transfers. Its AI-powered fraud protection, free tokenization for repeat orders, and built-in support for recurring payments make it a complete package.

2. PayPal

Everyone knows PayPal. That blue button is a symbol of trust for online shoppers. For an auto parts store, this is huge. It also offers Pay in 4 and PayPal Credit, which lets customers finance larger purchases — a fantastic tool for selling expensive performance parts.

This trust factor is critical when a customer is about to spend hundreds or thousands of dollars on a turbo kit or a new set of wheels from a store they’ve never used before. By offering PayPal, you borrow its reputation for security and buyer protection, which can significantly lower cart abandonment.

The financing options act as a powerful sales tool, turning a large and intimidating price tag into manageable monthly payments right at the point of sale.

- Best for: Universal trust and giving customers a familiar, fast way to pay.

- Pricing: Generally, a flat-rate percentage plus a fixed fee per transaction.

- Ease of use: Super easy. Customers log in to their PayPal account, and it’s done.

- Vital features: Massive brand recognition, built-in financing options, and strong buyer/seller protection.

3. Stripe

Stripe is a favorite of modern online businesses. It has a clean interface, powerful fraud-detection tools (called Radar), and handles everything from credit cards to Apple Pay and Google Pay seamlessly. It keeps customers on your site for checkout and is known for its reliability.

Beyond just processing payments, Stripe offers a whole ecosystem of tools that can grow with your business. Its fraud-fighting tool, Radar, uses machine learning to spot and block suspicious transactions, which is vital when you sell high-value parts.

For stores with unique needs, Stripe’s well-documented API allows for deep customization of the checkout flow, giving you complete control over the customer experience.

- Best for: A modern, flexible, and developer-friendly payment experience.

- Pricing: A competitive flat-rate percentage plus a fixed fee for each card charge.

- Ease of use: Very straightforward for customers. The merchant dashboard is clean and provides great data.

- Vital features: Top-notch fraud prevention, accepts a wide range of payment types, and offers great reporting tools.

4. Authorize Net

Authorize Net is one of the original and most trusted names in online payments. It’s a true workhorse. While it’s just a gateway (you still need a separate merchant account), it is incredibly stable and comes with an advanced fraud detection suite.

Working as a “gateway” means Authorize Net is the secure bridge between your X-Cart store and your merchant bank. This separation is popular with established businesses that have a long-standing relationship with their bank and have negotiated favorable processing rates. It’s a rock-solid, no-frills solution that prioritizes security and reliability above all else.

- Best for: Established businesses that want a reliable, secure, and widely supported payment gateway.

- Pricing: Usually a monthly gateway fee plus a small per-transaction fee, on top of your merchant account’s fees.

- Ease of use: Integration is well-supported. The customer experience is smooth, keeping them on your site.

- Vital features: Advanced fraud protection, excellent support, and wide acceptance by almost all US merchant account providers.

5. Square

If you have a counter where locals pick up parts, Square is a fantastic choice. It unifies your in-person and online sales. You can manage your inventory and payments from one dashboard. Its online payment processing is robust, secure, and easy to set up.

The real magic of Square is in its unified inventory management. When you sell a brake rotor in your physical shop, the stock count on your X-Cart store updates automatically. This prevents you from selling a part online that you no longer have, which saves you from customer service headaches and canceled orders. It creates one seamless operation for your entire business.

- Best for: Stores that have both a physical shop and an online presence.

- Pricing: Simple, flat-rate transaction fees with no hidden charges.

- Ease of use: Known for its simplicity for both the merchant and the customer.

- Vital features: Seamless sync between online and in-person sales, simple pricing, and strong hardware options.

6. Braintree

Owned by PayPal, Braintree is a full-stack platform that gives you the best of all worlds. With one integration, you can offer credit/debit cards, PayPal, Venmo, Apple Pay, and Google Pay. It’s built for growth and can handle complex business needs.

The inclusion of Venmo is a game-changer, especially if you sell to a younger, mobile-first audience. Customers can make purchases using their Venmo balance with the same ease as they send money to a friend. This flexibility shows your brand is modern and customer-focused, removing another barrier to purchase for a large and growing demographic

- Best for: Access to a huge range of payment options through a single integration.

- Pricing: Similar to Stripe and PayPal with flat-rate pricing. No monthly fees.

- Ease of use: The checkout experience is seamless for customers.

- Vital features: All-in-one access to PayPal, Venmo, and cards. Strong fraud tools and support for global currencies.

7. Amazon Pay

Millions of people have their payment and shipping info stored with Amazon. Amazon Pay lets them use that information on your site. This means a faster, easier checkout with fewer fields to fill out, which can be the final push a customer needs.

This system tackles “checkout anxiety” — the hesitation a customer feels when asked to create a new account and type in their address and card number on an unfamiliar site. By using their Amazon login, they skip all those steps. They know the process is secure and their information is safe, making them far more likely to complete the purchase.

- Best for: Reducing checkout friction and leveraging the trust of Amazon.

- Pricing: A percentage-based processing fee plus a fixed authorization fee.

- Ease of use: Incredibly easy for customers. They just log in with their Amazon credentials.

- Vital features: Huge built-in user base, A-to-Z Guarantee protection, and a faster checkout process.

8. Affirm

An auto part can be a sudden, expensive need. Affirm lets customers buy now and pay over time in simple monthly installments. You get paid in full right away. Offering this at checkout can dramatically boost your conversion rate on big-ticket items.

A key advantage of Affirm is its ability to display payment options directly on your product pages (e.g., “As low as $50/month”). This reframes the cost in more manageable terms before the customer even adds the item to their cart. It makes expensive performance upgrades feel more attainable and encourages customers to consider higher-priced items.

- Best for: Increasing sales on high-ticket items with Buy Now, Pay Later.

- Pricing: Affirm charges you a merchant fee on each transaction.

- Ease of use: Simple for the customer, who gets a real-time decision at checkout.

- Vital features: Boosts conversion on expensive items, you get paid upfront, and it assumes the risk.

9. Google Pay

Similar to Apple Pay, Google Pay allows hundreds of millions of users to pay with the card information saved to their Google account. It eliminates the need to manually enter card details, which speeds up checkout and reduces abandoned carts, especially on mobile.

Don’t mistake this for an Android-only feature. Anyone signed into a Google account on the Chrome browser, even on a desktop, can use Google Pay. This creates a consistent and fast checkout experience across devices. For your customers, it means no more “where’s my wallet?” moments — just a simple, secure click to buy.

- Best for: Offering a fast, secure, one-click payment option for Android and Chrome users.

- Pricing: There are no extra fees from Google; you just pay the standard processing rate of your connected gateway.

- Ease of use: Extremely simple for customers — often just a single click to pay.

- Vital features: Massive user base, enhanced security through tokenization, and a frictionless checkout experience.

10. 2Checkout (Now Verifone)

If you have customers around the globe, you need a solution that handles different currencies and payment methods. 2Checkout is a global leader. It supports dozens of currencies and payment types, making it easy for international customers to buy.

Selling internationally involves more than just different currencies; it involves complex tax rules and regulations. 2Checkout acts as a merchant of record, which means it can help manage the complexity of things like VAT and other international sales taxes for you. This lifts a significant administrative burden, letting you tap into global markets with confidence.

- Best for: Auto parts stores that sell and ship internationally.

- Pricing: Has different plans, but most common is a flat-rate fee per transaction that varies by country.

- Ease of use: Provides a localized checkout experience for your customers.

- Vital features: Excellent international support, multiple currencies, and a wide variety of global payment options.

11. Elavon / Converge

Elavon is a large, reputable payment processor that offers a complete solution through its Converge gateway. It’s a very stable and secure option for businesses of all sizes. It’s a great Authorize Net alternative if you want your merchant account and gateway from the same provider.

By working directly with a large processor like Elavon, high-volume businesses can often negotiate more favorable Interchange+ pricing models. Instead of a flat rate, you pay the raw bank interchange fee plus a small, fixed markup. This can result in significant savings on transaction costs as your sales grow.

- Best for: Businesses looking for a traditional, all-in-one merchant account and payment gateway from a major financial institution.

- Pricing: Typically involves monthly fees and custom-quoted transaction rates (Interchange+).

- Ease of use: The Converge platform is a powerful tool for managing payments.

- Vital features: All-in-one solution, strong security, and potential for lower rates at high volume.

12. BlueSnap

BlueSnap is an All-in-One Payment Platform designed to increase sales and reduce costs. It provides a merchant account and payment gateway in one, with excellent support for international payments and automatic recurring billing, perfect for subscription-based parts services.

One of BlueSnap’s standout features is its intelligent payment routing. In simple terms, if a customer’s card is declined by one bank, the platform can automatically retry the transaction through a different banking connection. This small technical detail can recover potentially lost sales and improve your overall transaction success rate without any effort on your part.

- Pricing: Offers simple flat-rate pricing for both US and international transactions.

- Best for: Global businesses that need a single platform for processing, gateway services, and subscription management.

- Ease of use: Features a smart system to improve success rates and a straightforward integration process.

- Vital features: Strong global payment support, built-in subscription tools, and advanced fraud prevention.

13. PayTomorrow

While Affirm is great for installment payments, PayTomorrow offers a wider range of financing options, including plans for customers with lower credit scores. This can open up sales for very expensive items like crate engines or full suspension kits that might otherwise be out of reach.

PayTomorrow helps you capture a segment of the market that might not qualify for traditional financing. By offering lease-to-own and other flexible payment plans, you provide a path to purchase for enthusiasts and mechanics who need the parts now but require a different payment structure. It’s an excellent tool for maximizing your customer base.

- Best for: Offering customers flexible financing and lease-to-own options for very large purchases.

- Pricing: You pay a merchant fee on each transaction, but it allows you to close sales you might have otherwise lost.

- Ease of use: Integrates into the checkout process, giving customers an instant decision on financing.

- Vital features: Caters to a broad range of credit profiles, offers multiple financing products, and gets you paid right away.

14. Skrill

Popular in Europe and growing worldwide, Skrill is another great option for reaching a global audience. It functions much like PayPal, with a focus on its digital wallet for fast and secure payments. It supports over 40 currencies and offers a clean checkout experience.

Skrill originally built its reputation in the fast-paced online gaming industry, where speed and security are paramount. This background means its platform is engineered for rapid, secure digital transactions. For an international customer base that is comfortable with digital wallets, offering Skrill can be a sign that your store is globally savvy and trustworthy.

- Best for: A strong alternative with a focus on digital wallets and global payments, especially in Europe.

- Pricing: Transaction fees are competitive, with a percentage-based model.

- Ease of use: Simple for customers with a Skrill account. The integration is straightforward.

- Vital features: Strong international presence, digital wallet functionality, and high security standards.

15. BitPay

Accepting cryptocurrency is a way to cater to a tech-savvy niche of customers and stand out from the competition. BitPay is the leading service for making this easy. It allows customers to pay in crypto, but you receive your payment in US Dollars (or other currency), so you aren’t exposed to price volatility.

The two main advantages of accepting crypto are significantly lower transaction fees (typically around 1%) compared to credit cards, and the complete elimination of chargeback fraud. Once a crypto payment is made, it cannot be reversed by the customer. For high-value, high-risk parts, this can provide an unparalleled level of payment security.

- Best for: Forward-thinking stores that want to accept cryptocurrency payments like Bitcoin.

- Pricing: A simple 1% processing fee to convert the crypto to your currency.

- Ease of use: Simple for the customer to pay from their crypto wallet. Easy for you to manage, as it works like any other payment.

- Vital features: No chargebacks, low transaction fees, and access to a growing market of crypto users.

Let’s Compare Best eCommerce Payment Gateway Solutions

| Payment Solution | Best For | Typical Pricing Model | Checkout Type | Key Feature for Auto Parts |

| X-Cart Pay | Simplicity & Native Integration | Flat Rate | On-Site | Unified support and management inside X-Cart |

| PayPal | Universal Trust | Flat Rate + Fixed Fee | Redirect / On-Site | Built-in financing options for expensive parts |

| Stripe | Modern & Flexible | Flat Rate + Fixed Fee | On-Site | Powerful fraud detection tools to protect big sales |

| Authorize Net | Reliability & Stability | Monthly Fee + Per Transaction | On-Site | A trusted workhorse for established businesses |

| Square | Online + Physical Stores | Flat Rate | On-Site | Unifies sales from your website and your front counter |

| Braintree | All-in-One Options | Flat Rate + Fixed Fee | On-Site | Accepts cards, PayPal, and Venmo in one package |

| Amazon Pay | Checkout Convenience | Percentage + Fixed Fee | On-Site (Widget) | Fast checkout for millions of Amazon users |

| Affirm | High-Value Items | Merchant Fee Per Sale | On-Site (Widget) | Lets customers finance large purchases, boosting sales |

| Google Pay | One-Click Convenience | Gateway’s Standard Rate | On-Site (Widget) | Frictionless checkout for Android and Chrome users |

| 2Checkout | International Sales | Country-Specific Flat Rate | On-Site / Redirect | Handles multiple currencies and global payment types |

| Elavon/Converge | Traditional All-in-One | Interchange+ / Custom | On-Site | Direct processor relationship, good for high volume |

| BlueSnap | Global Subscriptions | Flat Rate | On-Site | Intelligent routing improves transaction success rates |

| PayTomorrow | Maximum Financing Options | Merchant Fee Per Sale | On-Site (Widget) | Serves customers with a wider range of credit profiles |

| Skrill | European & Digital Wallets | Percentage-Based | Redirect | Strong global reach and secure digital wallet |

| BitPay | Cryptocurrency Users | 1% Flat Fee | Redirect | Eliminates chargebacks and has low transaction fees |

Choosing the right payment provider is a critical tune-up for your eCommerce engine. The perfect solution depends on your customers, your average sale price, and where you do business.

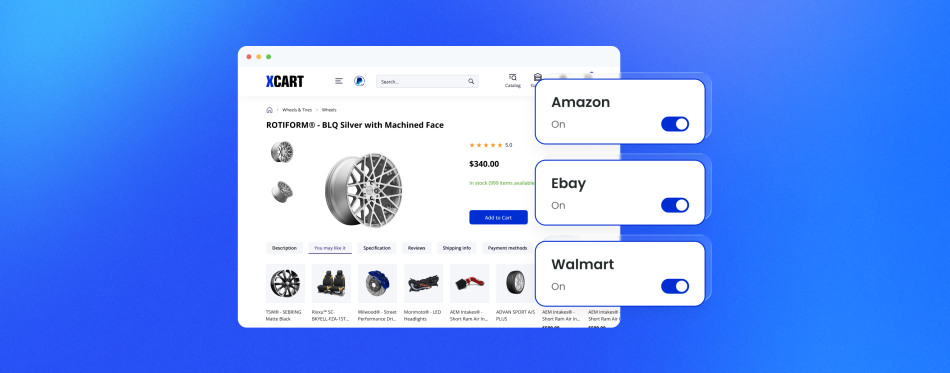

The great thing is, your X-Cart store is built to be flexible. You can browse these and many other options in the X-Cart app store. If you need a hand, our support team is always here to help you get wired up. Happy selling!

About the author